-

- HOME

- Voip Phone

- Search Engine

- Home Improvement / Renovation / Remodeling

- SEO

- Website Design

- Health & Beauty

- Education

- University

- Financial Services and Products

- Hotel

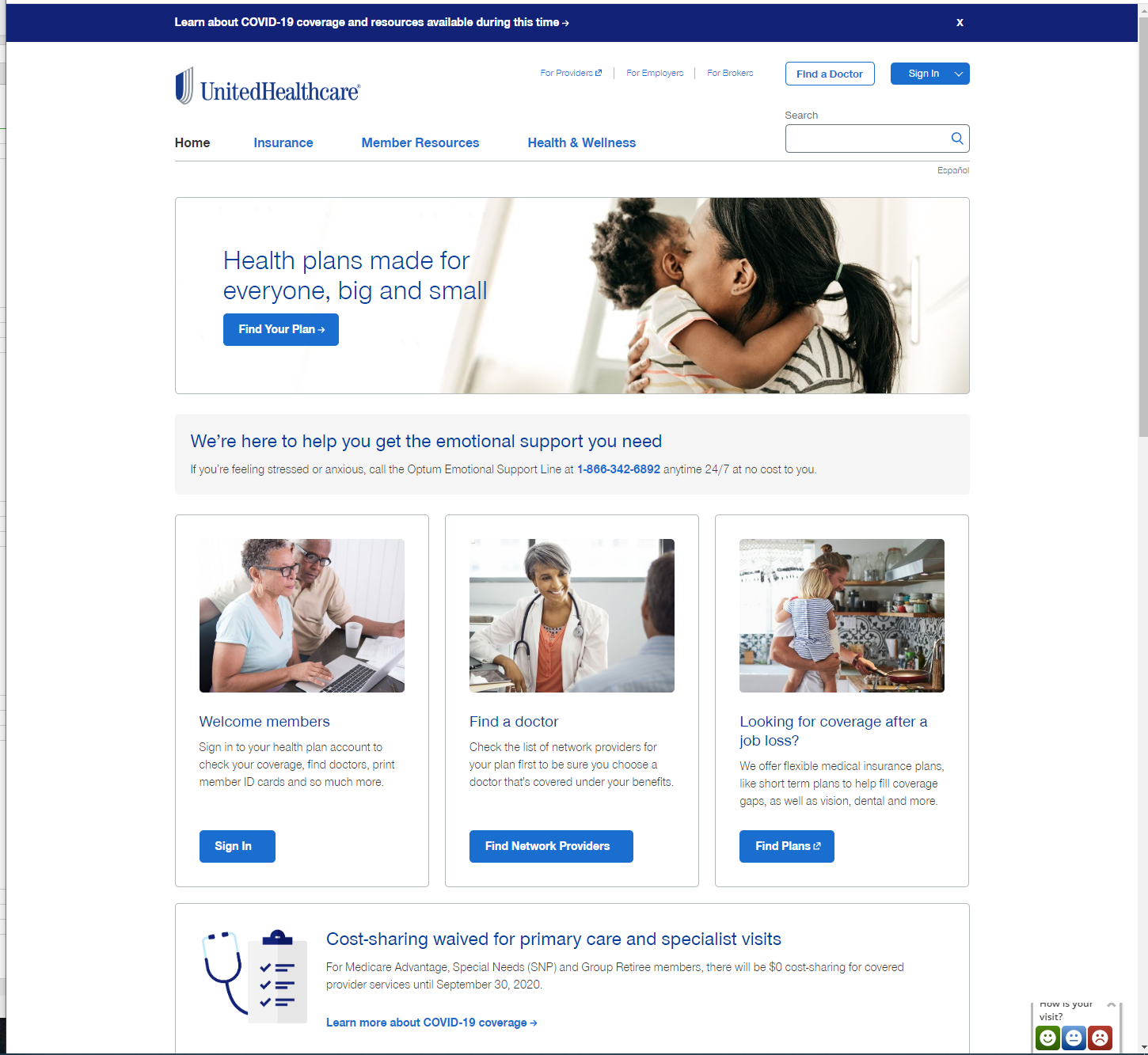

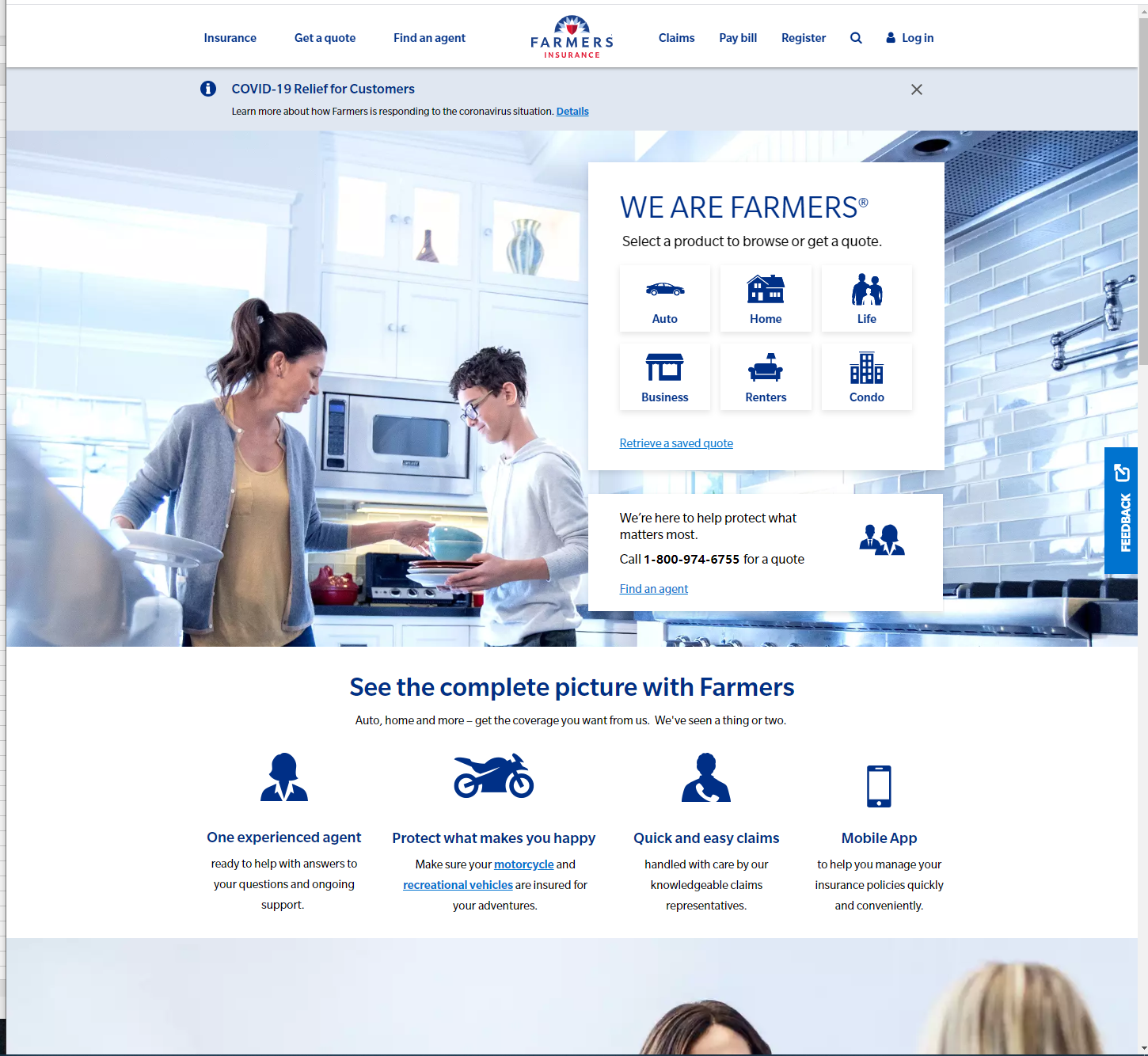

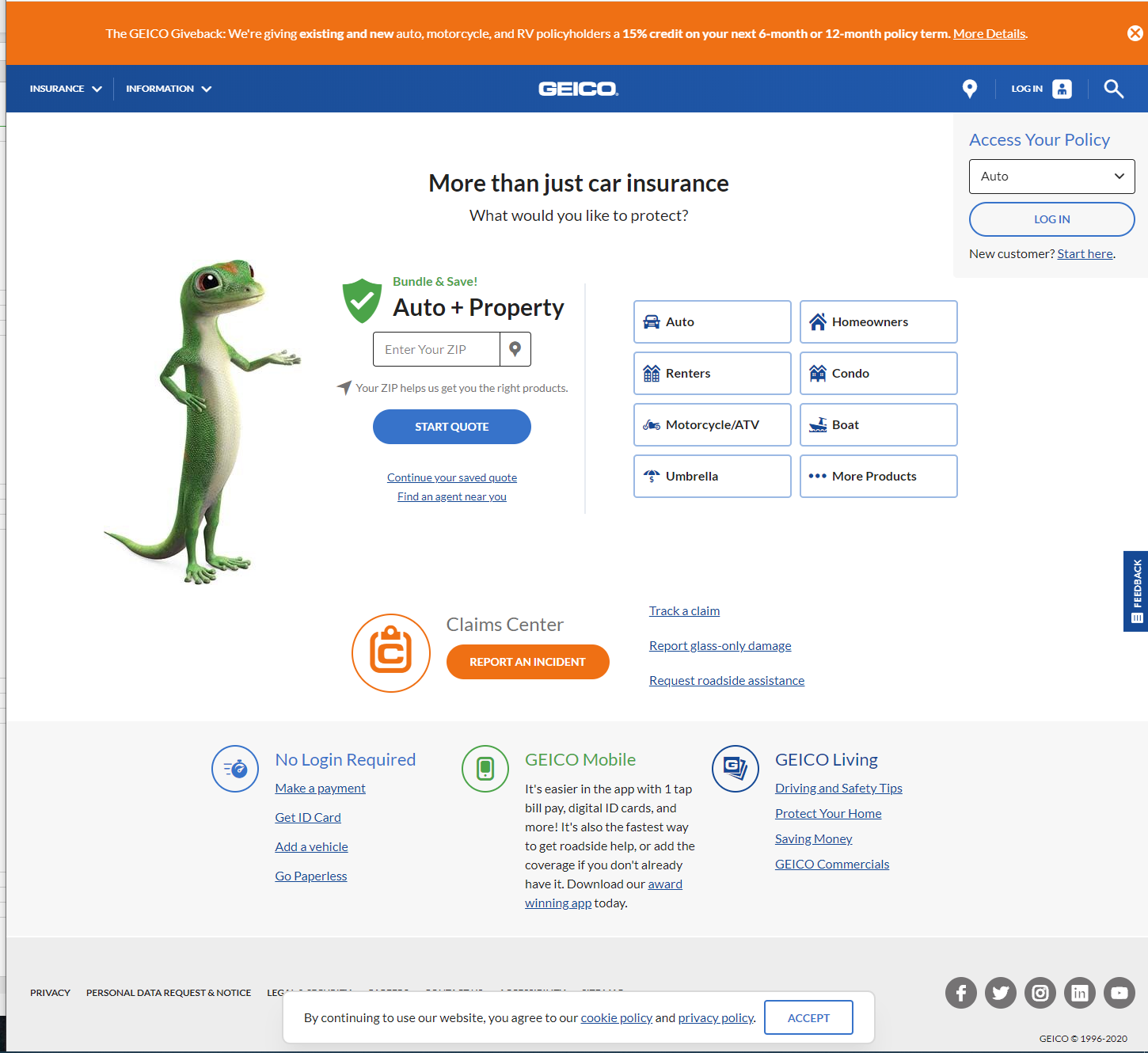

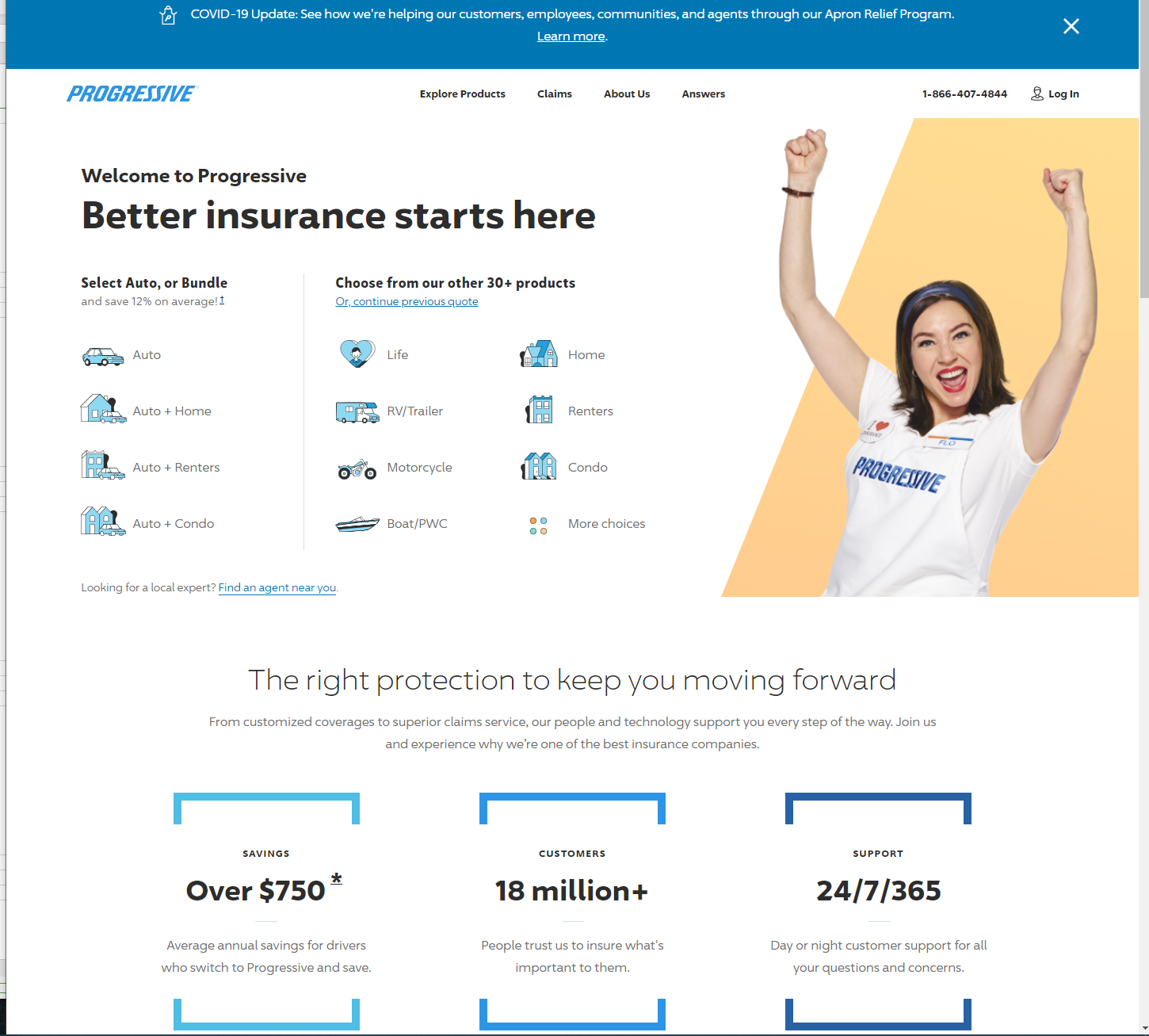

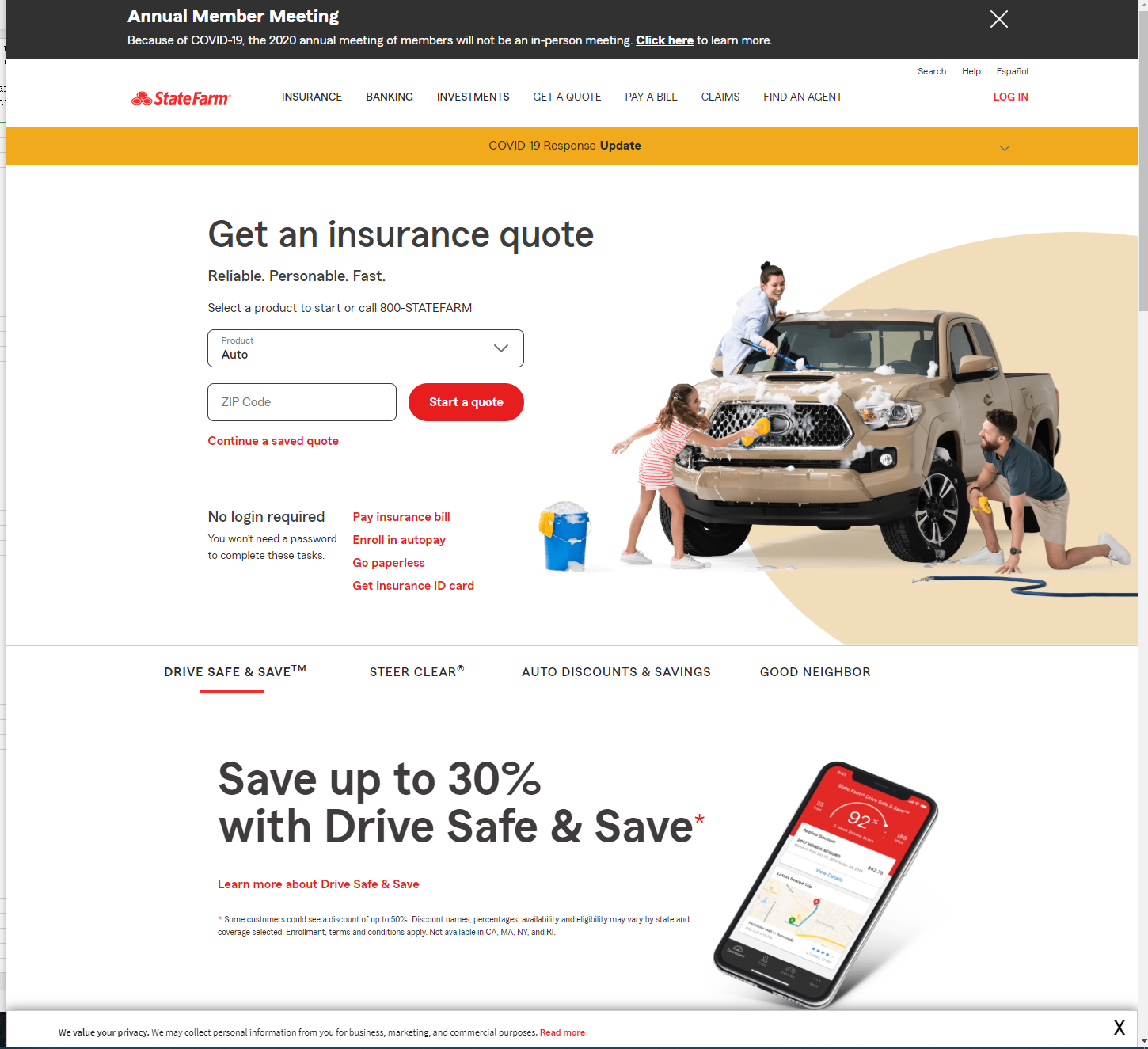

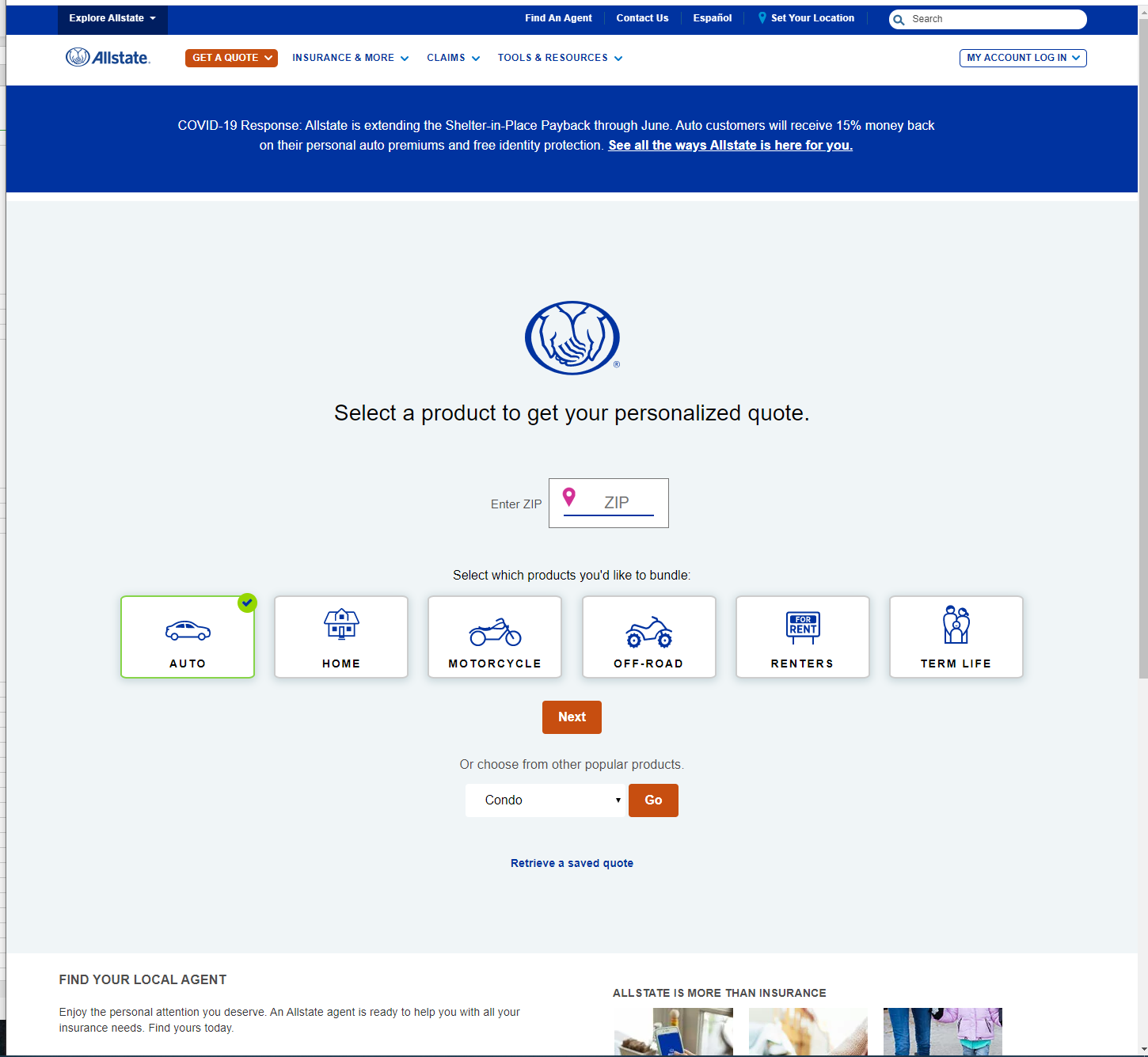

- Insurance

- Jewellery & Timepieces

- Outdoors & Recreation

- Photography

- Real Estate

- Sports

- Travel

- Vehicle

- Luxury

- Classified Ads

- Yatht

- E-Commerce